39 defined contribution pension plan canada

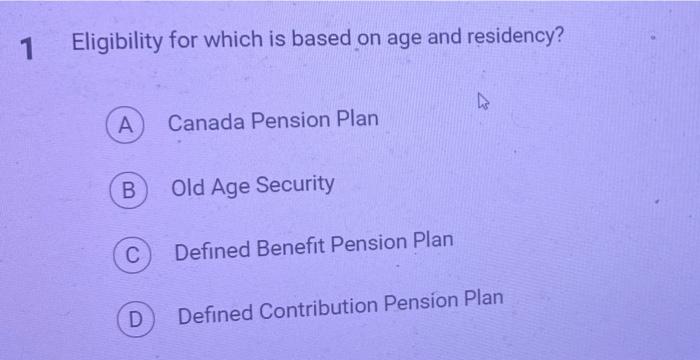

Defined Benefit Pension Plan in Canada: Fully Explained The DBPP is one of the two main pension plans used in Canada. The Defined Contribution Pension Plan (DCPP) is another pension plan that has become popular over the years. It can differ in several ways from the DBPP including: A DCPP requires employees to make contributions to their plan, and the employer may match their payments. Defined Contribution and 401K | Alight We make sure your defined contribution plan and 401k sets the course for a secure financial future with support every step of the way.

PDF 4 Defined Contribution Pension Plan (RPP) Welcome to ... The Sherwin-Williams Canada Inc. Salaried Employees Retirement Plan III, a Defined Contribution Pension Plan (DCPP) and a Registered Pension Plan (RPP) can help you accumulate funds for your retirement. You make no contributions to this Plan. All contributions to your account are made by the Company if you meet the eligibility requirements.

Defined contribution pension plan canada

Local Authorities Pension Plan (LAPP) - Quick Guide determined by the Canada Pension Plan annually. The 2016 YMPE is $54,900.00. ** Salary Cap is the maximum salary upon which the defined benefit limit is based as set by the Income Tax Act Canada. The 2016 Salary Cap is $160,970.00. Contribution Examples Annual Pensionable Salary $40,000 $80,000 Employee Contribution PDF Defined Contribution Pensions: Plan Rules, Participant ... Over the last 20 years, defined-contribution pension plans have gradu-ally replaced defined benefit pension plans as the primary privately-sponsored vehicle to provide retirement income. At year-end 2000, employers sponsored over 325,000 401(k) plans with more than 42 mil-lion active participants and $1.8 trillion in assets.1 Defined contribution pension options at retirement ... When you retire from a Defined Contribution Pension Plan, your retirement options are very different than the options from a Defined Benefit Pension Plan. The pension options you have will depend on a few different things but the biggest issues are the amount of money you have in the pension and your age. Related article: Pension Plans are the ...

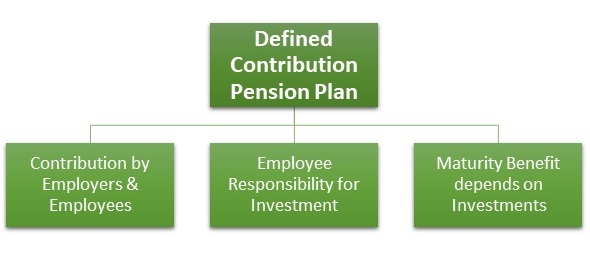

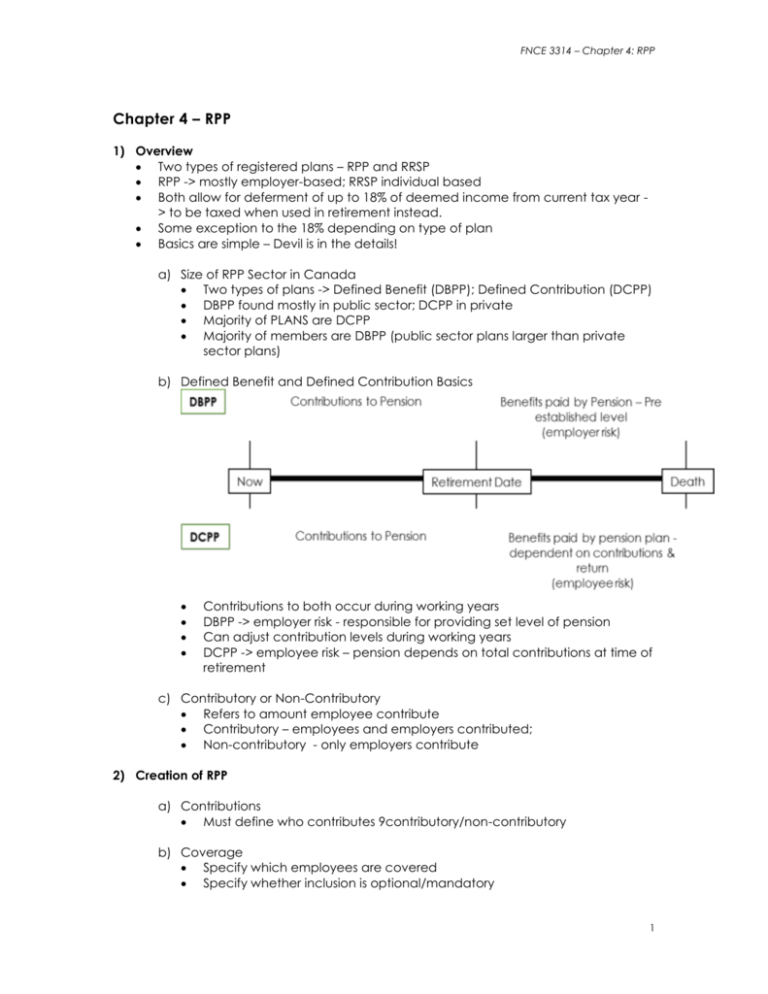

Defined contribution pension plan canada. Employer-sponsored pension plans - Canada.ca Defined contribution pension plans. In a defined contribution pension plan, you know how much you will pay into the plan but not how much you will get when you retire. Usually you and your employer pay a defined amount into your pension plan each year. The money in your defined contribution pension is invested in one or more products on your ... Defined contribution pension plan canada You can contribute up to 100% of your earnings to your pension each year or up to the annual allowance of £40,000 (2020/21). This means the total sum of any personal contributions, employer contributions and government tax relief received, can't exceed the £40,000 annual pension allowance. Defined Benefit vs Defined Contribution Pension Plans in ... There are two main types of registered pension plans in Canada - the Defined Benefit Pension Plan (DBPP) and Defined Contribution Pension Plan (DCPP). A brief definition of both plans is as follows: Defined Benefit Pension Plan In this pension plan, the employer promises to pay you a predetermined monthly income for life after retirement. Types Of Pension Plans And Their Pros And Cons | PlanEasy Owen Winkelmolen. Fee-for-service financial planner and founder of PlanEasy.ca. There are three main pension arrangements in Canada and most people, if they have a pension plan, have one of these three main types. There are defined benefit pensions, defined contribution pensions, and group-RRSPs. Each of these have their pros and cons.

Defined Contribution Plans - GroupBenefits.ca Defined Contribution Plans. Under a Defined Contribution Pension Plan (also called a "Money Purchase" Pension Plan), the contributions of plan members and plan sponsors are invested towards the funding of a retirement income. The maximum combined contribution is the lesser of 18% of earned income to the maximum contribution limit. Typically, the contribution going into the plan is known, while the final benefit is not known. Pension Solutions Canada - How Do I Calculate My Pension ... In a defined contribution pension plan, you know how much you will pay into the plan but not how much you will get when you retire. The total amount of your pension’s commuted value (CV) is calculated using standards, as required under the Ontario Pension Benefits Act, and depends on many factors including future interest and mortality rates, and inflation. TaxTips.ca - Defined Contribution Pension Plan Characteristics Characteristics of Defined Contribution Pension Plans (Money Purchase RPPs) Pensionable age is specified by the pension plan and can vary from plan to plan. Pension payments cannot be split between spouses, except in the case of a court ordered split, due to separation or divorce. Defined contribution pension plan - finiki, the Canadian ... Guaranteed Income Supplement (GIS) Canada Pension Plan (CPP) Québec Pension Plan (QPP) CPP and QPP calculator. v. t. e. A defined contribution pension plan ( DCPP or DC plan ) is one type of a Registered Pension Plan. A DCPP has no pre-determined payout at retirement, it is based on the assets in the plan at the time your retire.

Defined Contribution Plan Page Content. In a defined contribution plan, the employer and employee contribute a set or defined amount and the amount of pension income that the member receives upon retirement is determined by, among other things, the amount of contributions accumulated and the investment income earned. These contributions are often a fixed percentage of an employee's annual earnings and are deposited monthly in an individual account in the member's name. Defined Contribution Pension Plan in Canada: Complete Guide The Defined Contribution Pension Plan in Canada is one of the two popular pension plans used by Canadians. A Defined Benefit Pension Plan (DBPP) differs from a Defined Contribution Pension Plan in several ways: The company offering DBPP guarantees a fixed amount of income for their employees after their retirement. The DBPP is not a portable plan. Defined-Contribution Plan Definition The defined-contribution plan differs from a defined-benefit plan, also called a pension plan, which guarantees participants receive a certain benefit at a specific future date. › defined-benefit-pension-explainedDefined Benefit Pension Plan Canada: The Ultimate Guide ... Mar 01, 2021 · A defined contribution plan (also known as a DC pension plan in Canada), on the other hand, is funded mainly by you as the employee, but your employer can make contributions (e.g. match your contribution to a defined amount).

Pension regulation in Canada - Wikipedia Pension Benefits Act (Ontario) The Pension Benefits Act is administered by the Superintendent of Financial Services appointed by the Financial Services Commission of Ontario.Ontario regulates approximately 8,350 employment pension plans, which comprise more than 40 per cent of all registered pension plans in Canada. It was originally enacted as the Pension Benefits …

Defined contribution pension plan - Canada Life A defined contribution plan is the most common type of pension. Both you and your employer contribute a percent of your salary over the time that you're working, and when you retire you can convert that money into your retirement income. The amount that you receive depends on how much has been contributed and how well the investments have done.

What is a defined benefits pension plan? - Canada Life Canada Life only offers defined contribution plans, but you may have a defined benefit plan from another provider or an older plan. Defined benefit plans can be complicated, but here are the basics. Complex formula, consistent results With a defined benefit plan, your retirement income is decided by a formula.

Defined Benefit vs Defined Contribution Pension Plans ... The main differences between a defined benefit and defined contribution pension plan are who funds it, who manages it, and whether or not it pays out a predetermined amount. At the end of 2019 ...

Defined benefit vs. defined contribution: What is the best ... A defined contribution pension plan is one in which the employer and employee make contributions. Those contributions are invested over time to provide a payout at retirement. The final benefit amount of the pension is unknown because it is based on contributions and growth.

Defined Benefit Plan Defined Benefit Plan. A defined benefit plan provides members with a defined pension income when they retire. The formula used to determine a member's benefit usually involves factors such as years of membership in the pension plan and the member's salary, and is not dependent on the investment returns of the plan fund.

Cash Balance Pension Plan Calculator - Pension Deductions In the defined contribution plan, the benefit is communicated as an account balance in today’s dollars. The cash balance pension plan is a hybrid plan where the benefit is communicated as a dollar amount in today’s dollars and the annuity calculations are done at the back end.

Defined Contribution Pension Plans: Did You Know? A Defined Contribution Pension Plan Your employer or union may set up a defined contribution pension plan (DC pension plan) to assist you in retirement. It often looks like an investment account but has certain tax benefits and additional protections. Typically, you and your employer contribute a set amount through payroll deductions to your account in the plan.1 That's the "defined contribution." Your account

› retirement-pensions-2 › 710.2.6 Employer pension plans - Canada.ca A defined contribution pension plan establishes a set amount that you and your company will contribute to your plan each year. The amount is based on how much you make. Defined contribution plans don't guarantee what you will get when you retire; that depends on how well the plan is managed.

Defined-Contribution Plan Vs. Defined-Benefit Pension Plan ... Defined-Contribution (DC) Pension Plans This is the type of pension plan most commonly offered by employers. The benefits are based on contributions and investment returns. These pensions do not provide a guaranteed income in retirement, and they can be very risky depending on how well the plan investments perform.

Defined Contribution Pension Plan - RBC Royal Bank Royal Bank of Canada (RBC) is acting in its capacity as a delegate of your employer in connection with its Defined Contribution Pension Plan. MyAdvisor is a platform provided by RBC. Financial planning services and investment advice provided in connection with any RBC investment account opened outside the Defined Contribution Pension Plan is ...

cpcpension.com › homepage › index-eCanada Post | Pension Plan Membership is restricted to employees who meet the eligibility requirements of the Canada Post Corporation Registered Pension Plan. The official text of the Plan governs the actual benefits from the Plan and is the final authority in any case of dispute.

Can I withdraw money from my DCPP Canada? - TreeHozz.com A defined contribution pension plan (DCPP or DC plan ) is one type of a Registered Pension Plan. A DCPP has no pre-determined payout at retirement, it is based on the assets in the plan at the time your retire. The funds in a DCPP cannot be withdrawn before the owner retires.

Pensions in Canada: Defined Benefit vs Defined Contribution Defined Benefit plans are dying. There is clear shift world wide from Defined Benefit (DB) plans to Defined Contribution )DC) plans. In 2000, 65% of pensions were Defined Benefit plans but by 2010 only 56% of all pensions were Defined Benefit. In the US, DB plans were about 51% of all pensions in 2000. Ten years later, than number dropped to 43%.

Defined-Benefit vs. Defined-Contribution Plan Differences Employers fund and guarantee a specific retirement benefit amount for each participant of a defined-benefit pension plan. Defined-contribution plans are funded primarily by the employee, as the...

Defined Contribution Pension Plans Vs Group Rrsp: a Guide ... Defined Contribution Pension Plans are an employer-sponsored retirement savings option available to Canadian business owners and their employees. Defined Contribution Pensions Plans are made up of a combination of employee contributions, employers' contributions, and an optional voluntary contribution component.

Pension Plan Change Frequently Asked ... - Lockheed Martin A defined contribution plan gives you more control over your retirement savings by offering choices including your contribution level and your investment decisions. In addition to matching contributions and automatic company contributions, Lockheed Martin will provide you with tools and resources to help you maximize the value of your benefits.

› what-we-do › wealth-andDefined Benefits Pension Plan - Mercer Mercer can help defined benefits plans manage persistent risks, such as market volatility, uncertain liabilities, and pressure to reduce expense and contributions. To find out more about Mercer’s solutions for defined benefit pension plans please contact us.

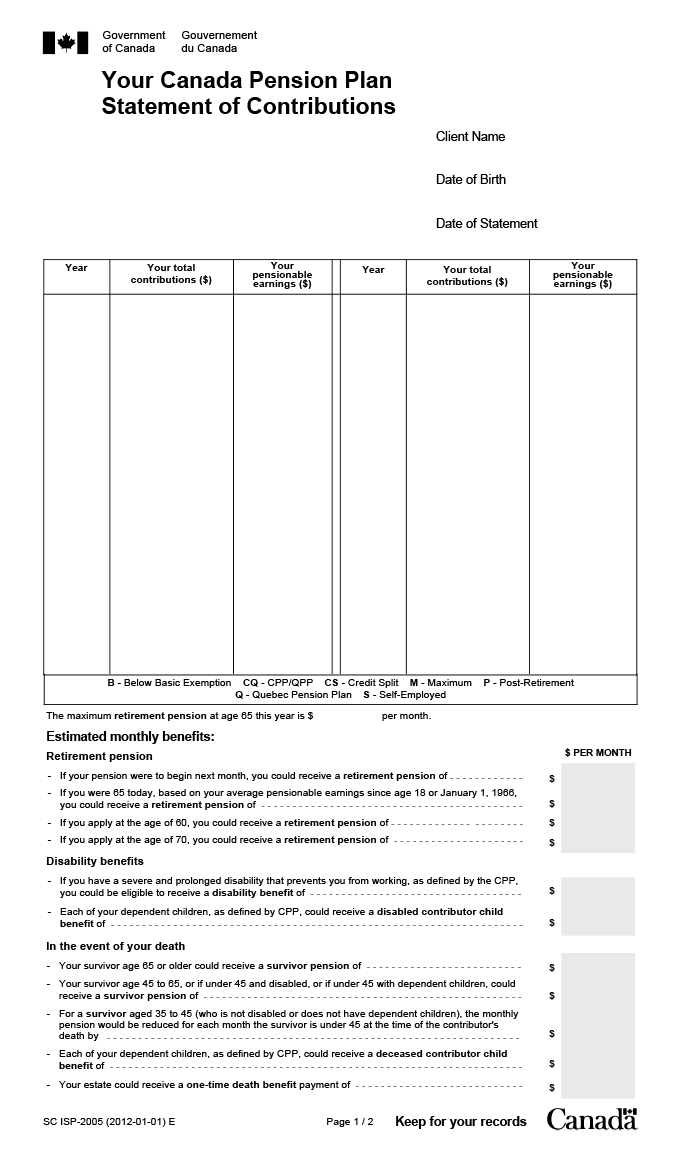

Canada Pension Plan disability benefit toolkit - Canada.ca Canada Pension Plan (CPP) A mandatory public insurance plan that provides contributors and their families with partial replacement of earnings in the case of retirement, disability or death. Canada Pension Plan death benefit A one-time, lump-sum payment to the estate on behalf of a deceased CPP contributor. Canada Pension Plan disability pension

Defined contribution pension options at retirement ... When you retire from a Defined Contribution Pension Plan, your retirement options are very different than the options from a Defined Benefit Pension Plan. The pension options you have will depend on a few different things but the biggest issues are the amount of money you have in the pension and your age. Related article: Pension Plans are the ...

PDF Defined Contribution Pensions: Plan Rules, Participant ... Over the last 20 years, defined-contribution pension plans have gradu-ally replaced defined benefit pension plans as the primary privately-sponsored vehicle to provide retirement income. At year-end 2000, employers sponsored over 325,000 401(k) plans with more than 42 mil-lion active participants and $1.8 trillion in assets.1

Local Authorities Pension Plan (LAPP) - Quick Guide determined by the Canada Pension Plan annually. The 2016 YMPE is $54,900.00. ** Salary Cap is the maximum salary upon which the defined benefit limit is based as set by the Income Tax Act Canada. The 2016 Salary Cap is $160,970.00. Contribution Examples Annual Pensionable Salary $40,000 $80,000 Employee Contribution

/https://www.thestar.com/content/dam/thestar/business/personal_finance/retirement/2011/09/23/royal_bank_ends_definedbenefit_pensions_for_new_hires/rbc.jpeg)

0 Response to "39 defined contribution pension plan canada"

Post a Comment