40 notes payable asset or liability

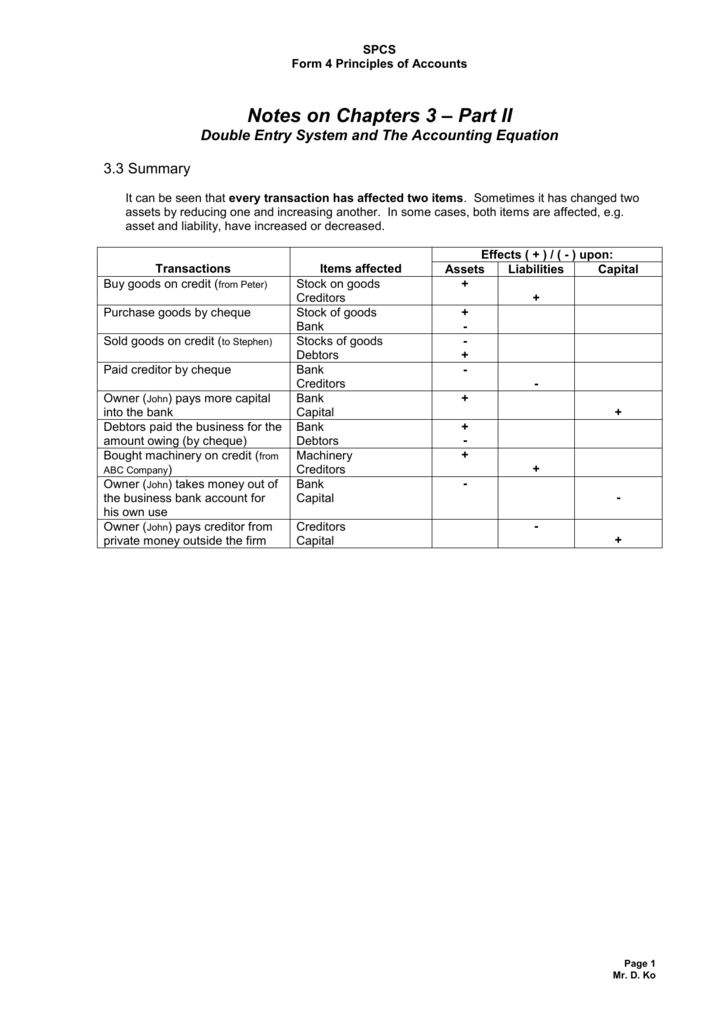

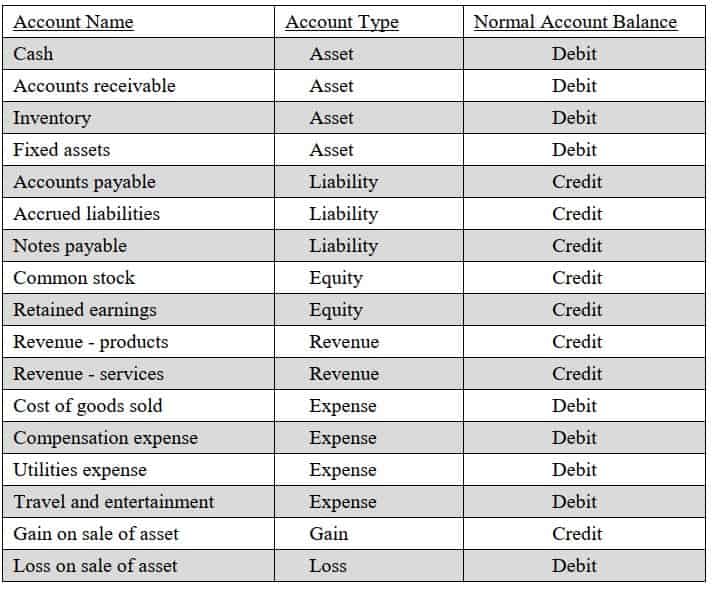

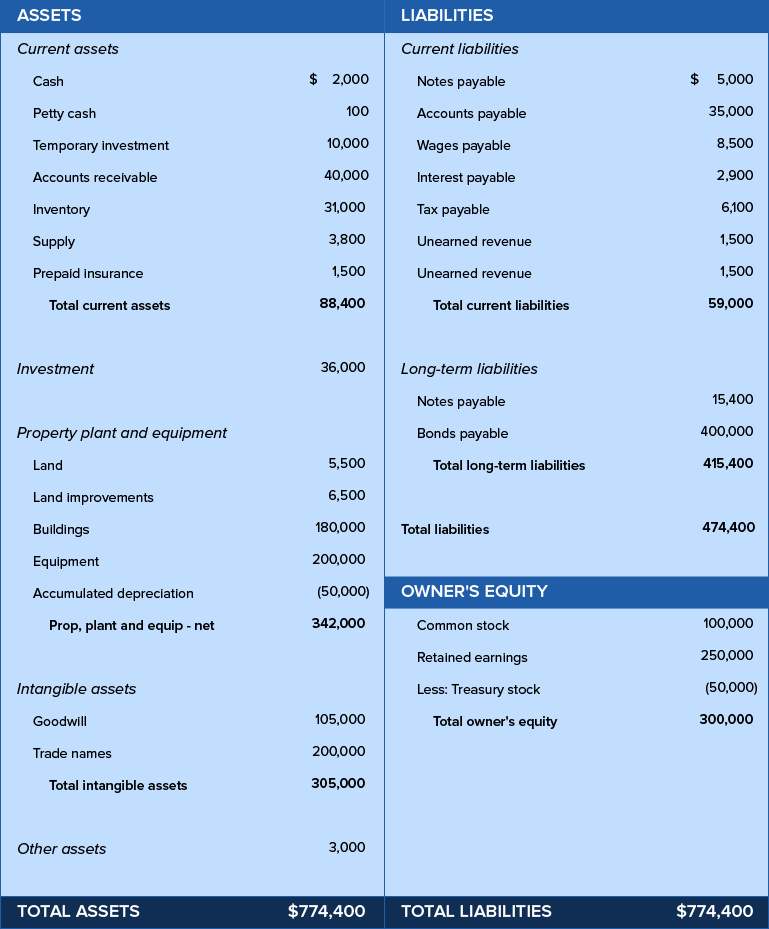

Is notes payable an asset or a liability? - Answers Best Answer Copy Accounts Payable and Notes Payable are liabilities. Accounts receivable - assets All "payable" accounts are "liabilities". This is because a liability is something the company... Notes Payable | Definition, Explanation, Journal Entries ... Notes payable is a liability that results from purchases of goods and services or loans. Usually, any written instrument that includes interest is a form of long-term debt. Notes Payable: Explanation A firm may issue a long-term note payable for a variety of reasons.

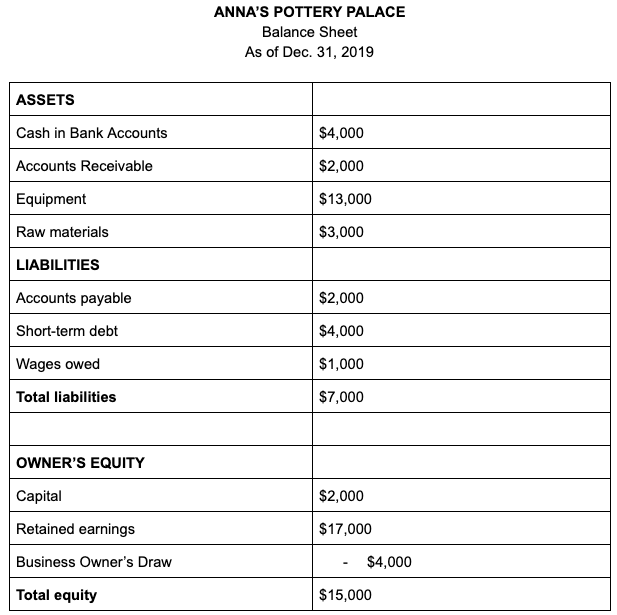

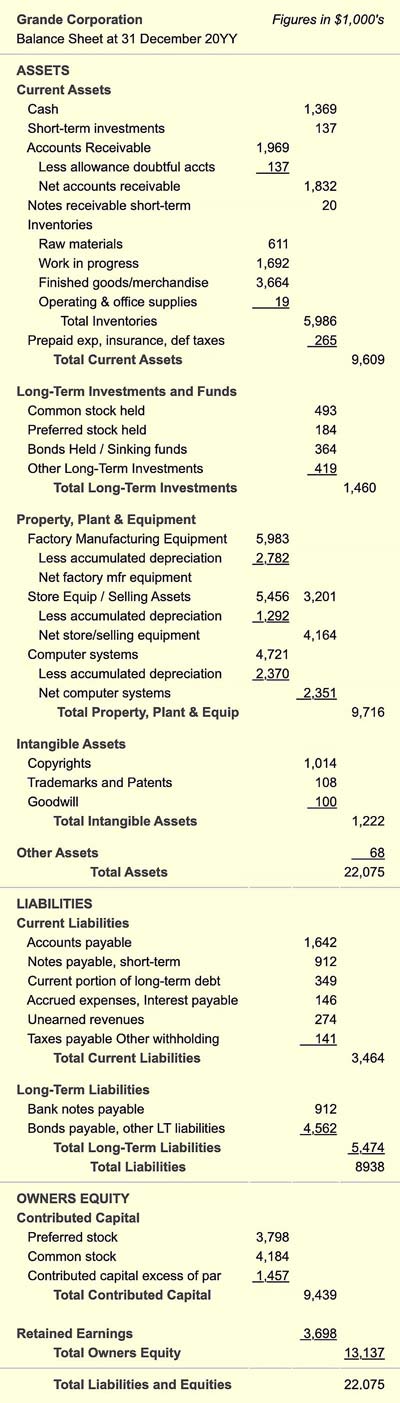

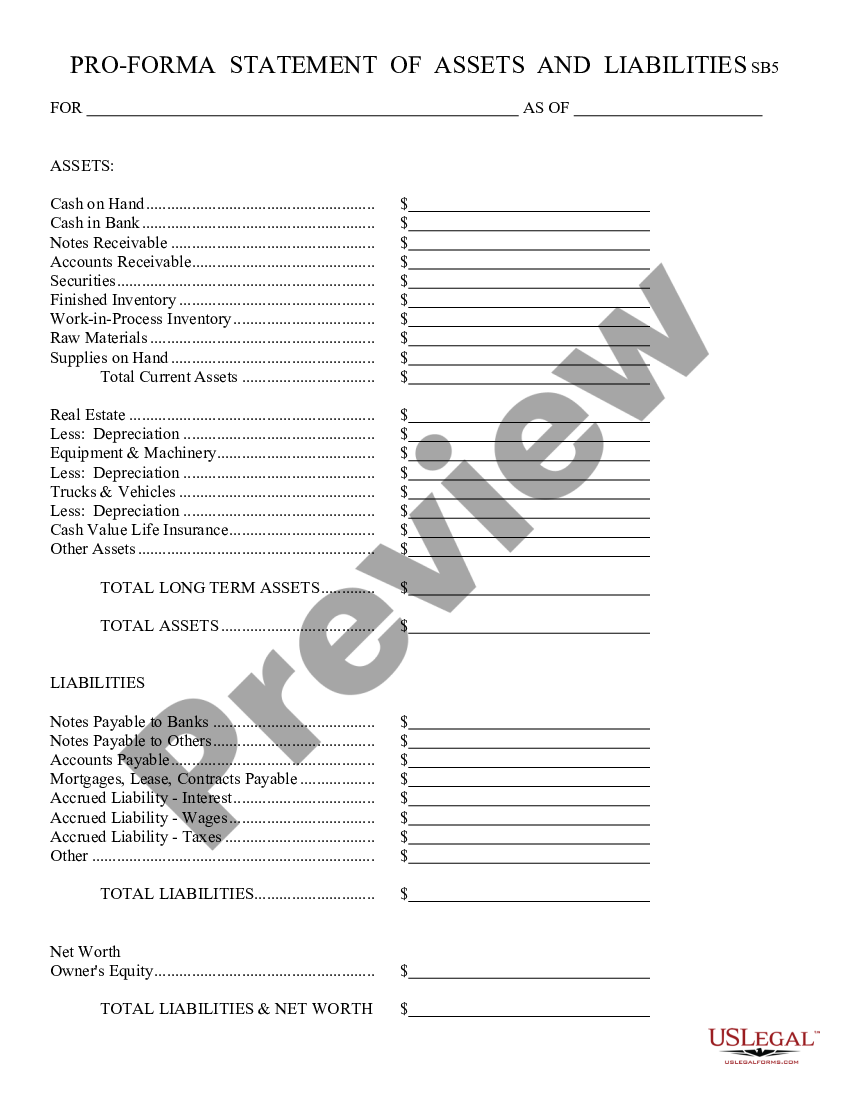

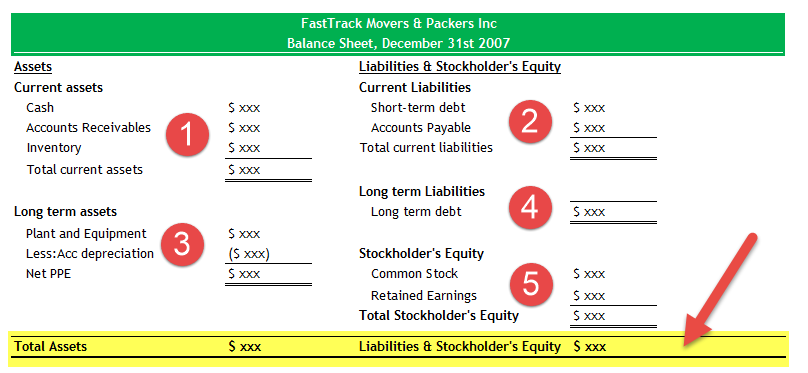

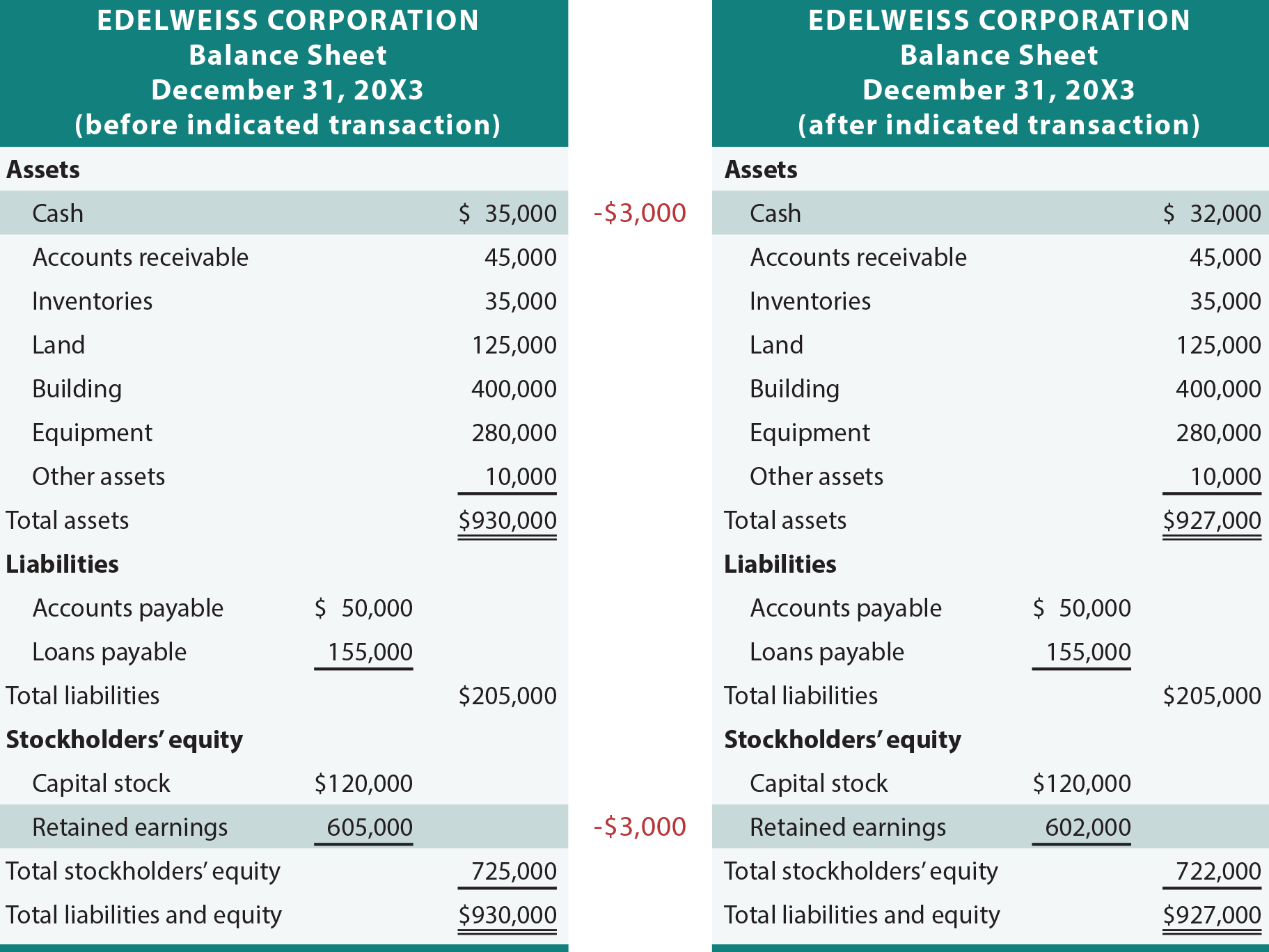

The Difference in Notes Payable Vs. Long-Term Debt | Bizfluent A "note payable" is evidence of a debt. Notes payable can provide needed capital to a business, but, like other debts and obligations, the liability detracts from the business's total equity. Businesses report notes payable as a current or long-term debt on the balance sheet.

Notes payable asset or liability

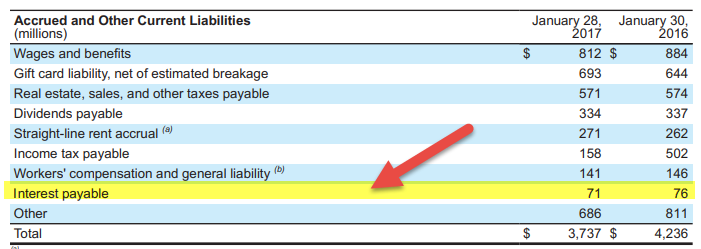

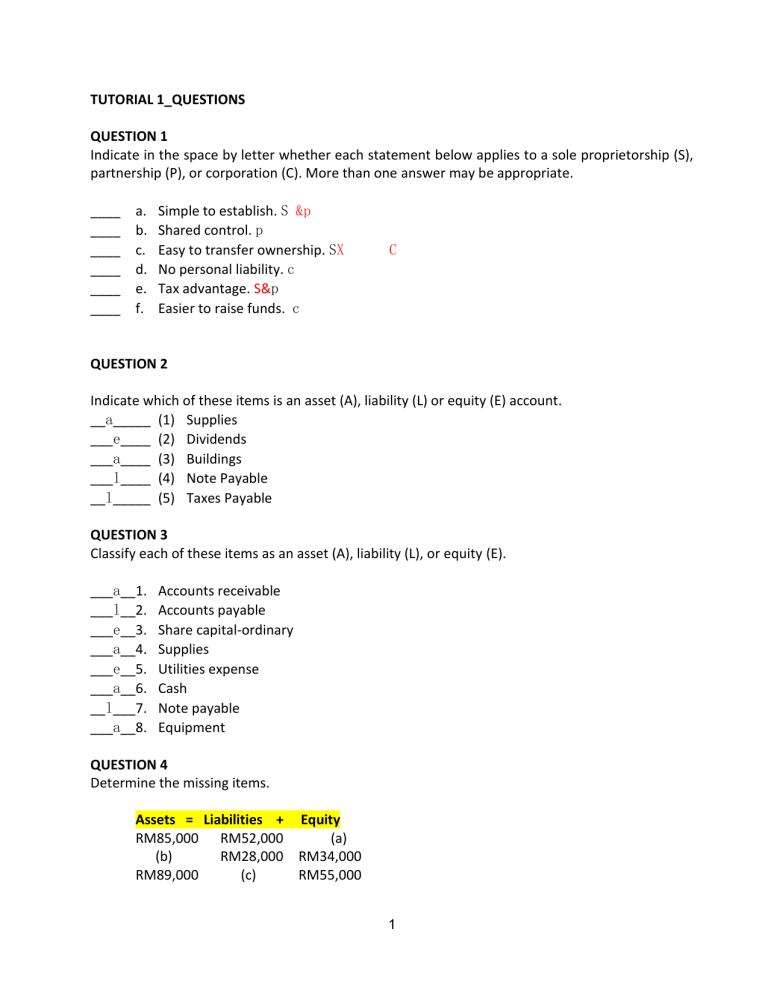

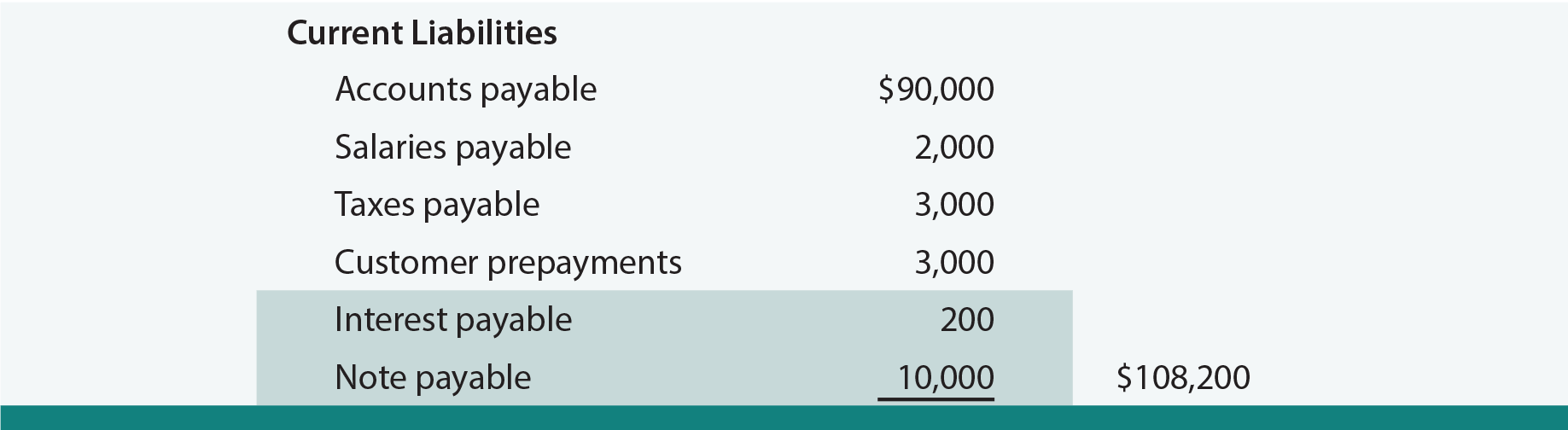

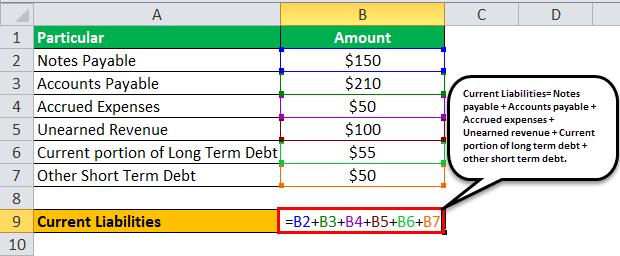

How Do Accounts Payable Show on the Balance Sheet? Other current liabilities can include notes payable and accrued expenses. Current liabilities are differentiated from long-term liabilities because current liabilities are short-term obligations... Solved Consider the following accounts and identify each ... Answer: a Notes Receivable A b Nunez, Capital E c Prepaid insurance A d Notes payable L… View the full answer Transcribed image text : Consider the following accounts and identify each account as an asset (A), liability (L), or equity (E). Notes Payable vs. Accounts Payable (With FAQs) | Indeed.com Notes payable keeps track of all promissory notes made by a company to vendors or lenders. This account acts as a liability account, so the company credits the notes payable account while it debits cash or another asset against it.

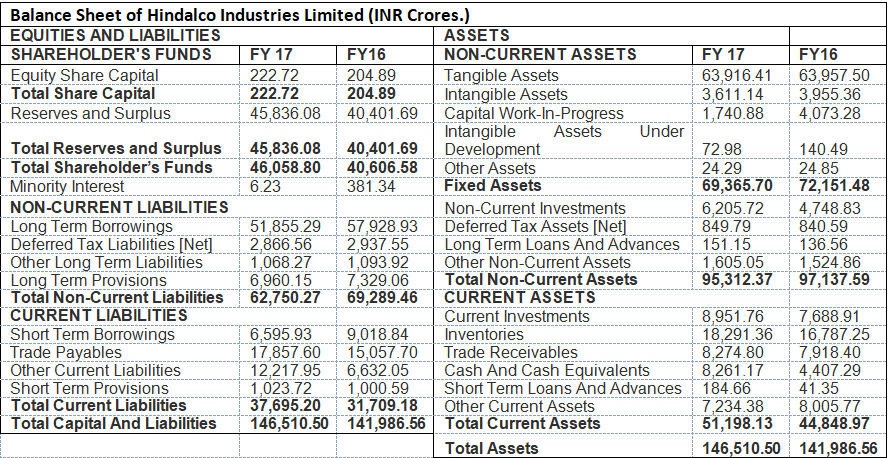

Notes payable asset or liability. Balance Sheet - Liabilities, Current Liabilities ... Short-term loans payable could appear as notes payable or short-term debt. For instance, if a company obtains a 6-month bank loan on December 31, 2020 for $100,000 and agrees to pay interest at the end of each month at the annual interest rate of 10%, the company's balance sheet as of December 31, 2020 will report a current liability of $100,000. Accounts Payable - General Ledger Account | AccountingCoach (Many companies report Notes Payable due within one year as the first item.) As a liability account, Accounts Payable is expected to have a credit balance. Hence, a credit entry will increase the balance in Accounts Payable and a debit entry will decrease the balance. A bill or invoice from a supplier of goods or services on credit is often referred to as a vendor invoice. … Types of Liability Accounts | List of Examples ... Notes Payable – A note payable is a long-term contract to borrow money from a creditor. The most common notes payable are mortgages and personal notes. Unearned Revenue – Unearned revenue is slightly different from other liabilities because it doesn’t involve direct borrowing. Unearned revenue arises when a company sells goods or services to a customer … Are Bonds assets or liabilities? 4.9/5 (181 Views . 26 Votes) Assets = Liabilities + Equity. Generally, bonds payable fall in the long-term class of liabilities. Bonds are issued at a premium, at a discount, or at par. When a bond is issued, the issuer records the face value of the bond as the bonds payable. Lot more interesting detail can be read here.

Notes payable definition - AccountingTools Presentation of Notes Payable A note payable is classified in the balance sheet as a short-term liability if it is due within the next 12 months, or as a long-term liability if it is due at a later date. When a long-term note payable has a short-term component, the amount due within the next 12 months is separately stated as a short-term liability. Notes Payable - Learn How to Book NP on a Balance Sheet While Notes Payable is a liability, Notes Receivable is an asset. Notes Receivable record the value of promissory notes that a business owns, and for that reason, they are recorded as an asset. NP is a liability which records the value of promissory notes that a business will have to pay. Are accounts payable assets, liabilities, or equity ... Examples of the asset include investments, accounts receivable, supplies, land, equipment, and cash. Liabilities. A liability, in general, is an obligation to, or something that you owe somebody else. Liabilities are defined as a company's legal financial debts or obligations that arise during the course of business operations. Accounting Principles II: Understanding Notes Payable Understanding Notes Payable Understanding Notes Payable A liability is created when a company signs a note for the purpose of borrowing money or extending its payment period credit. A note may be signed for an overdue invoice when the company needs to extend its payment, when the company borrows cash, or in exchange for an asset.

NOTE 5 - Liabilities Payable from Restricted Assets ... Notes & Samples. NOTE 5 - Long-Term Liabilities Liabilities Payable from Restricted Assets. Liabilities payable from restricted assets are liabilities associated with the acquisition of restricted assets or liabilities that will be liquidated with restricted assets. Segregate current liabilities from long-term liabilities and report separately. Is discount on notes payable an asset? - AskingLot.com Assets = Liabilities + Equity of a business. While Notes Payable is a liability, Notes Receivable is an asset. Notes Receivable record the value of promissory notes that a business should receive, and for that reason, they are recorded as an asset. Likewise, people ask, what is discount on notes payable? discount on notes payable definition. Chapter 1 Flashcards - Quizlet Indicate whether each of the following items is an asset, liability, or part of owner's equity: a) accounts receivable b) salaries and wages payable c) equipment d) supplies e) owner's capital f) notes payable g) accounts payable h) cash. a) asset b) liability c) asset d) asset e) owner's equity f) liability g) liability h) asset. Liabilities definition - AccountingTools 24.12.2021 · A liability can be considered a source of funds, since an amount owed to a third party is essentially borrowed cash that can then be used to support the asset base of a business. Examples of liabilities are accounts payable, accrued liabilities, deferred revenue, interest payable, notes payable, taxes payable, and wages payable. Of the preceding liabilities, …

Accounts Payable vs Accounts Receivable - Overview, Examples Accounts payable is a current liability account that keeps track of money that you owe to any third party. The third parties can be banks, companies, or even someone who you borrowed money from. One common example of accounts payable are purchases made for goods or services from other companies. Depending on the terms for repayment, the amounts are …

Notes Payable Journal Entry: (Example and How to Record ... Both Notes payable and current liabilities are the results of a past transaction that obligates the entity. Current liabilities are one of two-part of liabilities, and hence, Notes payable are liabilities. The nature of Notes payable does not match with those of assets or equity in a nutshell.

A Beginner's Guide to Notes Payable | The Blueprint Notes payable is a formal agreement, or promissory note, between your business and a bank, financial institution, or other lender. Unlike accounts payable, which is considered a short-term...

Accounts Payable Vs Notes Payable: 7 Differences you ... Payable liability is likely to have collateral security attached to it. It is worthy of note that NP also has an interest rate with a specified repayment date. The borrower is therefore aware of the time of repaying the debt and the specific amount to be paid back to the lender. Differences between Account Payable and Notes Payable

How to Calculate Notes Payable & Long-Term Liabilities on ... Notes payable refers to money borrowed for the company for which the company issues a promissory note to the lender. The promissory note includes the face value of the note, the interest rate and the term of the note. A note payable can be a current liability if it is due within the year or a long-term debt if it extends beyond the year.

Are notes payable current or long term liabilities? Definition of Notes Payable The balance in Notes Payable represents the amounts that remain to be paid. the amount due within one year of the balance sheet date will be a current liability, and. the amount not due within one year of the balance sheet date will be a noncurrent or long-term liability. Click to see full answer.

Notes Payable Accounting | Double Entry Bookkeeping Are notes payable interest bearing debt? Yes. A note payable is an interest bearing debt. Where is notes payable on balance sheet? A note payable is shown under either current or long term liabilities on the balance sheet. Is a note payable an asset? No. A note payable is a liability. Do notes payable go on an income statement? No.

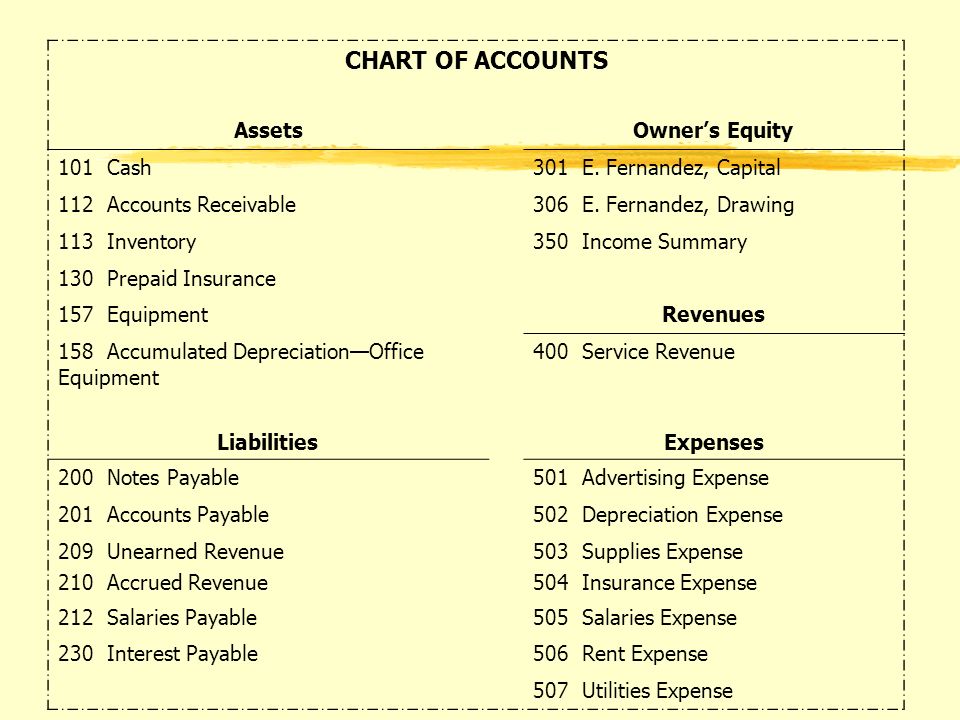

Account Types | Financial Accounting - Lumen Learning Asset: Something a business has or owns; Liability: Something we owe to a non-owner; ... Liability: Notes Payable: Liability: Common Stock: Equity: Retained Earnings: Equity: Service Revenue: Revenue: Interest Revenue: Revenue: Utilities Expense: Expense: Rent Expense: Expense: Supplies Expense: Expense: Wages Expense : Expense: Taxes Expense: Expense: …

Answered: Total Asset P 57,7 Liabilities and… | bartleby Transcribed Image Text: Ackerman Limousine Service Balance Sheet December31, 2020 Assets Cash P 16,000 Accounts Receivable 2,500 Automobile Supplies 1,200 Limousines 38,000 Total Asset P 57.700 Liabilities and Capital Accounts Payable P 3,200 Notes Payable 30,350 Total Liabilities P 33,550 Mikasa Ackerman, Capital 24,150 Total Liabilities and Capital P.57,700

Accounts Payable - Related Expense or Asset | AccountingCoach As a result these amounts will not have been entered into the Accounts Payable account (and the related expense or asset account). These documents should be reviewed in order to determine whether a liability and an expense have actually been incurred by the company as of the end of the accounting period.

Notes Payable on Balance Sheet (Definition, Journal Entries) Firstly, the company puts notes payable as a short-term liability. The company puts it as a short-term liability when the duration of that particular note payable is due within a year. As we see from the above example, CBRE has a current portion of notes of 133.94 million and $10.26 million in 2005 and 2004, respectively. Long-Term Notes Payable. On the other hand, if the note …

Assets, Liabilities, or Equity?? Flashcards | Quizlet Start studying Assets, Liabilities, or Equity??. Learn vocabulary, terms, and more with flashcards, games, and other study tools. ... Notes receivable. Asset - increases with debit journal entry. Equipment. Asset - increases with debit journal entry. Accounts payable. Liability - increases with credit journal entry. Wages payable. Liability ...

Accounts Payable: Asset or Liability? | Indeed.com Accounts payable, or AP, is a liability account, while account receivable, or AR, is a current asset account. AP monitors outstanding amounts that a company owes to its vendors, like purchases of goods and services from other companies. These amounts are due within a short period of time.

Asset leasing get started - Finance | Dynamics 365 ... 14.01.2022 · Vendor liability (subledger)/Notes payable: Asset depreciation. The right-of-use asset is depreciated over whichever is less - the asset useful life or the lease term. The method for calculating depreciation for US GAAP operating lease (ASC 842) is based on the difference between the straight-line lease expense and the interest amount. Depreciation on finance …

Security Deposit Liability | Double Entry Bookkeeping 19.11.2019 · When a customer pays a security deposit, a business needs to record a security deposit liability. If the deposit is refundable within the a year, then the liability will be shown as a current liability, if not, then it should be shown as a long-term liability in the balance sheet. Security Deposit Liability Journal Entry Example

What is Notes Payable? - AccountingCoach.com Definition of Notes Payable In accounting, Notes Payable is a general ledger liability account in which a company records the face amounts of the promissory notes that it has issued. The balance in Notes Payable represents the amounts that remain to be paid.

Notes Payable: U.S. GAAP Accounting Definition Notes Payable Definition. The “Notes Payable” line item is recorded on the balance sheet as a current liability – and represents a written agreement between a borrower and lender specifying the obligation of repayment at a later date. Also contained within the notes payable are the terms stipulated between the two parties, such as:

Is Accounts Payable A Liability Or An Asset? | PLANERGY ... Note: Companies can also use accounts payable to purchase assets such as equipment, property, etc. In such a scenario, your accounts team would debit an asset account, rather than an expense account, for the first entry. Managing Your Liabilities Effectively Can Be an Asset

Notes Payable vs. Accounts Payable (With FAQs) | Indeed.com Notes payable keeps track of all promissory notes made by a company to vendors or lenders. This account acts as a liability account, so the company credits the notes payable account while it debits cash or another asset against it.

Solved Consider the following accounts and identify each ... Answer: a Notes Receivable A b Nunez, Capital E c Prepaid insurance A d Notes payable L… View the full answer Transcribed image text : Consider the following accounts and identify each account as an asset (A), liability (L), or equity (E).

How Do Accounts Payable Show on the Balance Sheet? Other current liabilities can include notes payable and accrued expenses. Current liabilities are differentiated from long-term liabilities because current liabilities are short-term obligations...

0 Response to "40 notes payable asset or liability"

Post a Comment