43 retirement saving contribution credit

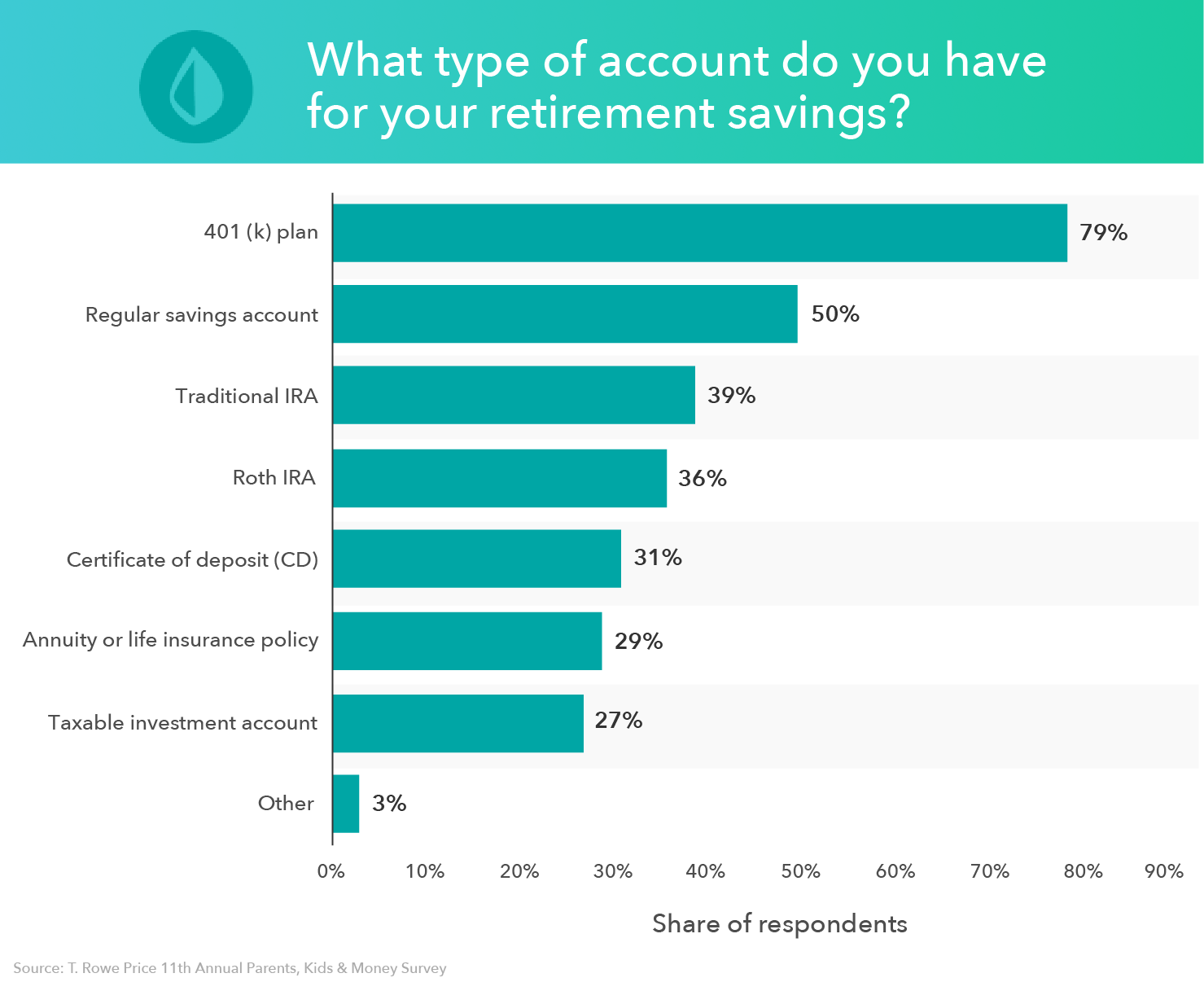

Retirement | PocketSense The SECURE Act of 2019: How It Affects Retirement in 2020. The SECURE Act of 2019 will make it easier for employers to offer 401(k) and other retirement plans to their employees. The Act should also make it easier for employees to make contributions towards these plans and their financial futures. → Learn More . Retirement. That Makes Cents: What's Better, an … › articles › investingWhy Saving 10% Won’t Get You Through Retirement Nov 19, 2021 · Saving 10% of your salary per year for retirement doesn’t take into account that younger workers earn less than older ones. 401(k) accounts offer considerably higher annual contribution limits ...

EOF

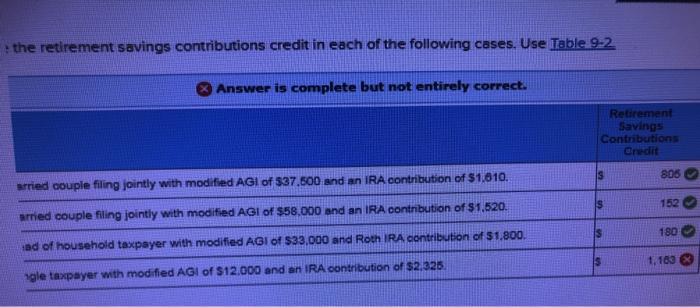

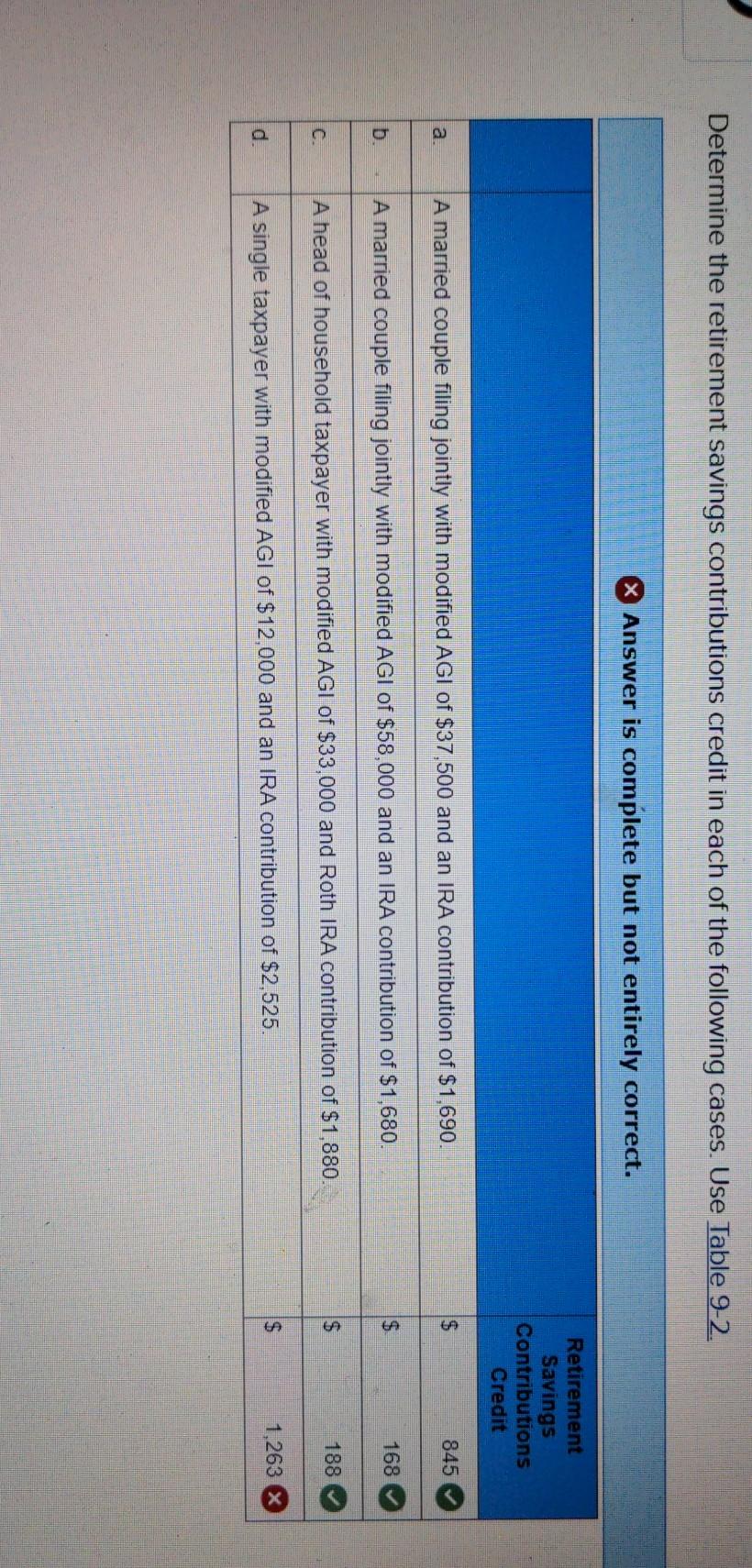

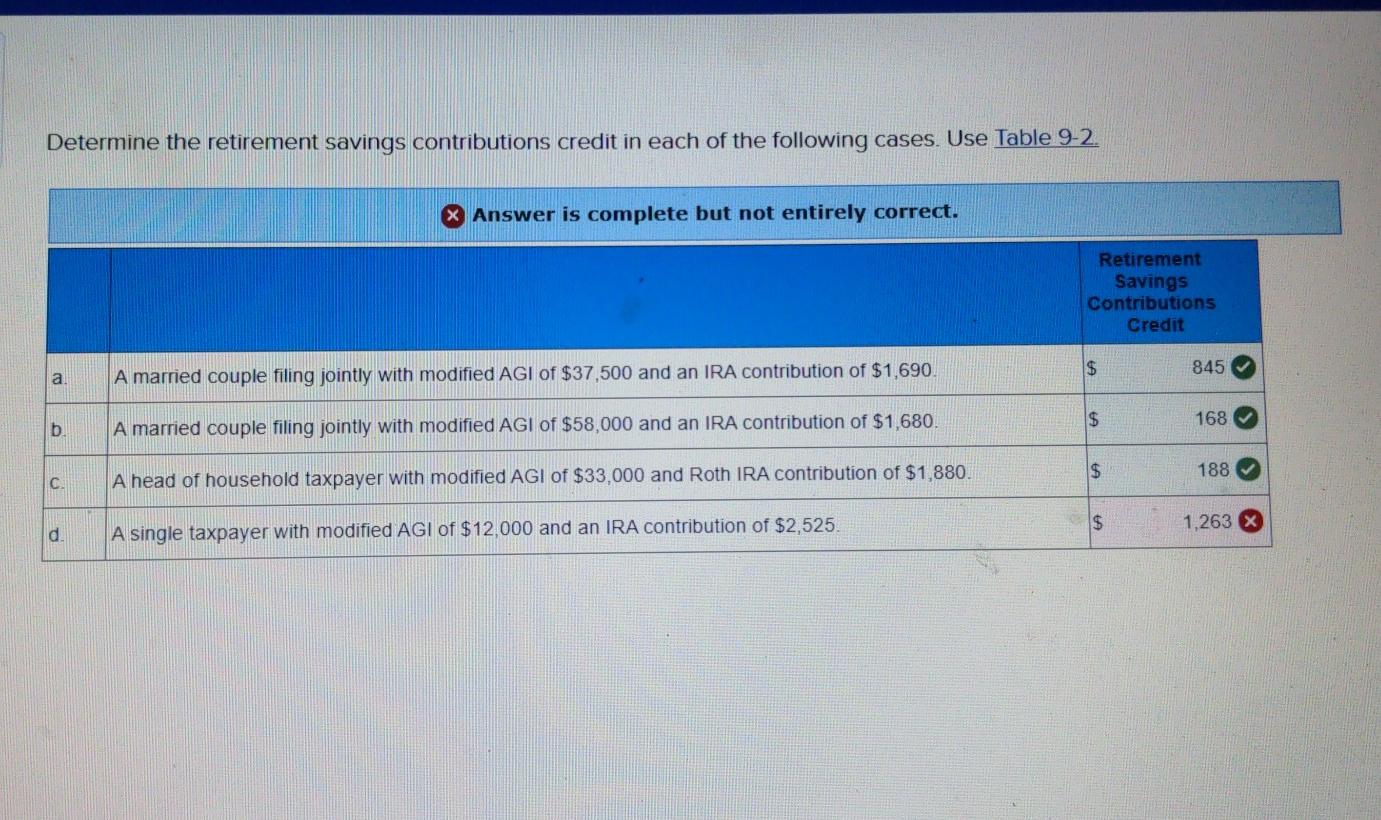

Retirement saving contribution credit

› investing › 2022/01/20This Is Your Biggest Enemy When Saving for Retirement | The ... Jan 20, 2022 · Credit Cards. Best Credit Cards; ... Monthly Contribution Annual Interest Rate ... $500: 10%: $986,964: Data Source: Calculations by author While any amount of saving for retirement is a good ... › articles › personal-financeIRA vs. Life Insurance for Retirement Saving: What's the ... Jan 19, 2022 · IRA vs. Life Insurance for Retirement Saving: An Overview When saving for retirement, a 401(k) plan is a great place to start, especially if your employer matches a portion of your contribution. Qualified Retirement Savings Contribution Credit Definition the qualified retirement savings contribution credit, often abbreviated as the "saver's credit," encourages low-income individuals to contribute to their qualified retirement plans by ultimately...

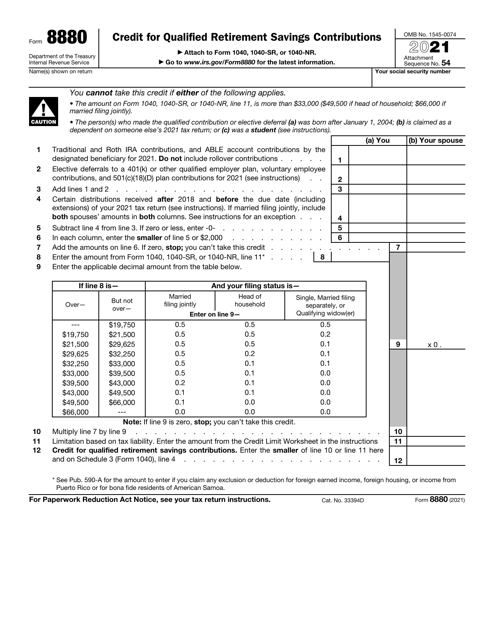

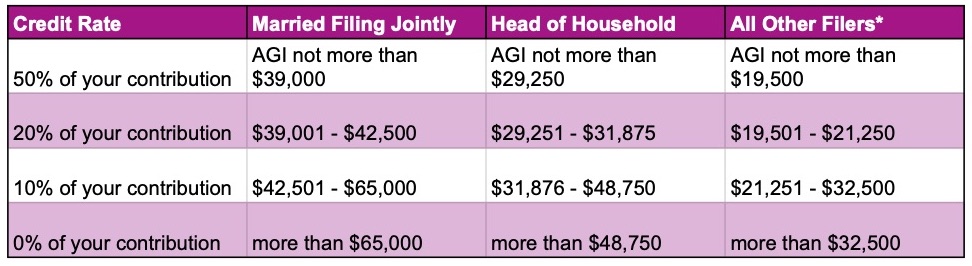

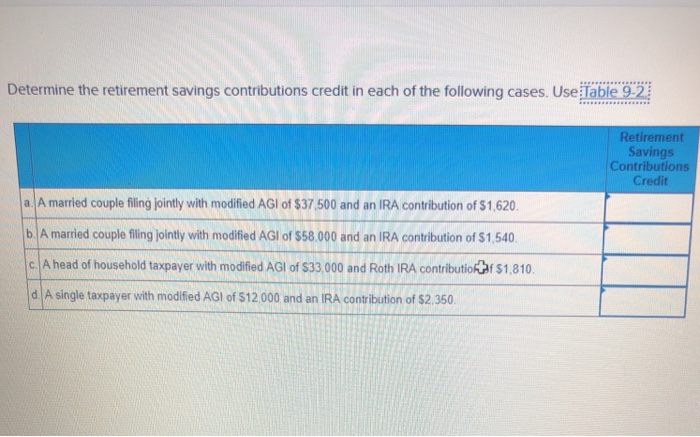

Retirement saving contribution credit. Saver's Credit: What It Is & How It Works in 2021-2022 The retirement savings contribution credit — the "saver's credit" for short — is a tax credit worth up to $1,000 ($2,000 if married filing jointly) for mid- and low-income taxpayers who contribute... Retirement Savings Contributions Savers Credit | Internal ... See Form 8880, Credit for Qualified Retirement Savings Contributions, for more information. Amount of the credit Depending on your adjusted gross income reported on your Form 1040 series return, the amount of the credit is 50%, 20% or 10% of: contributions you make to a traditional or Roth IRA, Retirement Resources | Bankrate.com Make your retirement plan solid with tips, advice and tools on individual retirement accounts, 401k plans and more. Commonly Overlooked Tax Breaks However, what many overlook is the Retirement Savings Contributions Credit, also known as the Saver's Credit. Depending on your adjusted gross income, you may qualify for a tax credit of up to 50% of the amount you contribute to a qualifying retirement plan. The minimum available credit is 10% of the amount of your contribution.

My Retirement Plan Savings Calculator - Wells Fargo Whether you're just starting to plan for retirement or have been saving for years, My Retirement Plan makes it easy to take the next step in planning for retirement. While most online retirement planning tools offer a one-size-fits-all approach, My Retirement Plan provides a realistic savings goal tailored to you — and a realistic plan for pursuing that goal. Retirement Savings Contributions Credit - eSmart Tax Retirement Savings Contributions Credit. If you contributed to an IRA or an employer-sponsored retirement plan in 2015, you may be eligible for a credit. This nonrefundable credit is based on the adjusted gross income and can be up to $1,000 per taxpayer. It can be taken in addition to the deduction of the traditional IRA contribution. Everything You Need To Know About the Retirement Saver's ... The saver's credit, also known as the retirement savings contributions credit, provides these taxpayers with a special tax break. They can claim the credit for a portion of the income they contribute to a qualifying retirement plan. Key Takeaways The Retirement Savings Contributions Credit is designed for low- and moderate-income taxpayers. money.usnews.com › money › retirementNew 401(k) Contribution Limits for 2022 | 401ks | US News Nov 15, 2021 · Retirement savers are eligible to put $1,000 more in a 401(k) plan next year. The 401(k) contribution limit will increase to $20,500 in 2022. Some of the income limits for 401(k) plans will also ...

Solved: Retirement Savings Contribution Credit The saver's tax credit is a non-refundable tax credit available to eligible taxpayers who make salary-deferral contributions to employer-sponsored 401 (k), 403 (b), SIMPLE, SEP, or governmental 457 plans. It is likewise available to those who contribute to traditional and/or Roth IRAs. What Is the Savers Credit? - TurboTax Tax Tips & Videos Formerly called the Retirement Savings Contributions Credit, the Savers Credit gives a special tax break to low- and moderate-income taxpayers who are saving for retirement. This credit is in addition to the other tax benefits for saving in a retirement account. If you qualify, a Savers Credit can reduce or even eliminate your tax bill. How do I remove a retirement saving contribution credit? if turbotax was giving you a $125 saver's credit, you either entered an ira contribution (including possibly applying a prior-year excess contribution as a current-year contribution), a self-employed retirement contribution, your w-2 entry showed code d, e, f, g, h, s, aa, bb or ee in box 12 for a retirement contribution or you indicated that you … Get Up to $2,000 for Contributing to a Roth IRA in 2022 ... The credit is designed to encourage low- and moderate-income taxpayers to stash money away for retirement. This hidden tax benefit can save you up to $2,000 on your tax bill in 2022.

savingmatters.dol.gov › employeesFor Workers - Retirement Savings Education Campaign - Saving ... If your employer offers a defined contribution retirement plan, like a 401(k) plan, you may have to make the decision to participate. As part of that decision, you choose how much to have deducted from your paycheck. Some employers have automatic enrollment 401(k) plans so that you are automatically signed up for the plan unless you opt out.

Topic No. 610 Retirement Savings Contributions Credit ... The amount of the saver's credit you can get can be as low as 10% or as high as 50% and is generally based on the contributions you make and your adjusted gross income.

Forms - U.S. Office of Personnel Management 2012 Premiums for Life Insurance. FEGLI announces premium changes effective January 1st, 2012.

Calculators Federal Ballpark E$timate® - Step 3 - Savings ... Catch-up Contributions * Contribution $ What are catch-up contributions? - link opens in new window Non-TSP Savings * Current Balance $ * Additional Annual Savings $ What are non-TSP savings? - link opens in new window. Projected Post-Retirement Income * Post-Retirmement Income per Year (today's dollars) $ * Years Worked Post-Retirement

What is the Retirement Savings Contributions Credit? The Retirement Savings Contribution Credit (aka the "Saver's Credit") is a tax credit that the IRS offers to incentivize low and moderate income taxpayers to make retirement contributions to an eligible retirement account (e.g. IRA, 401K, 403B, 457B, or any other IRS recognized retirement account).

Saver's Tax Credit: A Retirement Savings Incentive What Is the Saver's Credit? The saver's tax credit is a nonrefundable tax credit available to eligible taxpayers who make salary deferral contributions to employer-sponsored 401 (k), 403 (b),...

› retirement-savingsThe Retirement Savings Contribution Tax Credit Feb 16, 2022 · The Retirement Savings Contributions Credit is a federal income tax credit designed to encourage low- and modest-income individuals to save for retirement. Sometimes referred to as the "Saver's Credit," the credit equals 10% to 50% of your contributions for the year, up to certain limits.

Qualified Retirement Savings Contribution Credit Definition the qualified retirement savings contribution credit, often abbreviated as the "saver's credit," encourages low-income individuals to contribute to their qualified retirement plans by ultimately...

› articles › personal-financeIRA vs. Life Insurance for Retirement Saving: What's the ... Jan 19, 2022 · IRA vs. Life Insurance for Retirement Saving: An Overview When saving for retirement, a 401(k) plan is a great place to start, especially if your employer matches a portion of your contribution.

› investing › 2022/01/20This Is Your Biggest Enemy When Saving for Retirement | The ... Jan 20, 2022 · Credit Cards. Best Credit Cards; ... Monthly Contribution Annual Interest Rate ... $500: 10%: $986,964: Data Source: Calculations by author While any amount of saving for retirement is a good ...

/IRSForm8880-7d0c81ec36474e89b8dcbea8c7ced5fc.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/focused-female-it-professional-holding-document-while-looking-at-computer-in-creative-office-1171809278-a1aa73d9e79d4b8d921a86882a6ebd3f.jpg)

0 Response to "43 retirement saving contribution credit"

Post a Comment